Being a landlord comes with its fair share of challenges and uncertainties. Property ownership, unfortunately, isn't just about collecting rent; it involves navigating potential pitfalls that could impact your financial stability. Enter landlord insurance—a non-negotiable in the landlord experience. Ever wondered what would happen if your property sustained damage from a fire, floor, or hurricane? How about being prepared for legal tussles with tenants? Landlord insurance addresses these concerns head-on. It's not just about covering the property; it's a shield against loss of rental income during repairs or legal battles. As a landlord, have you considered how you'd handle a situation where your property becomes temporarily uninhabitable, and your income takes a hit? These are the real questions that landlord insurance answers, providing a practical solution to the genuine pain points landlords face in the unpredictable world of property management.

What is Landlord Insurance?

Landlord insurance is a type of insurance policy designed to protect individuals who own and rent out residential or commercial properties. It provides coverage for risks and liabilities that are specific to property owners who lease their properties to tenants. Landlord insurance typically offers protection in the following areas:

Property Damage: This coverage protects the physical structure of the rental property from risks such as fire, vandalism, and natural disasters.

Liability Coverage: This provides protection in case the landlord is found legally responsible for injuries to tenants, guests, or others while they are on the rental property.

Loss of Rental Income: If the rental property becomes uninhabitable due to a covered event (such as fire or flood), this coverage helps compensate the landlord for the lost rental income during the repair or reconstruction period.

Legal Expenses: Landlord insurance may cover legal fees associated with disputes between landlords and tenants, such as eviction proceedings or property damage claims.

Personal Property: Some policies may cover the landlord's personal property that is left on-site for maintenance or repair purposes.

How is Landlord Insurance Different from Homeowners Insurance?

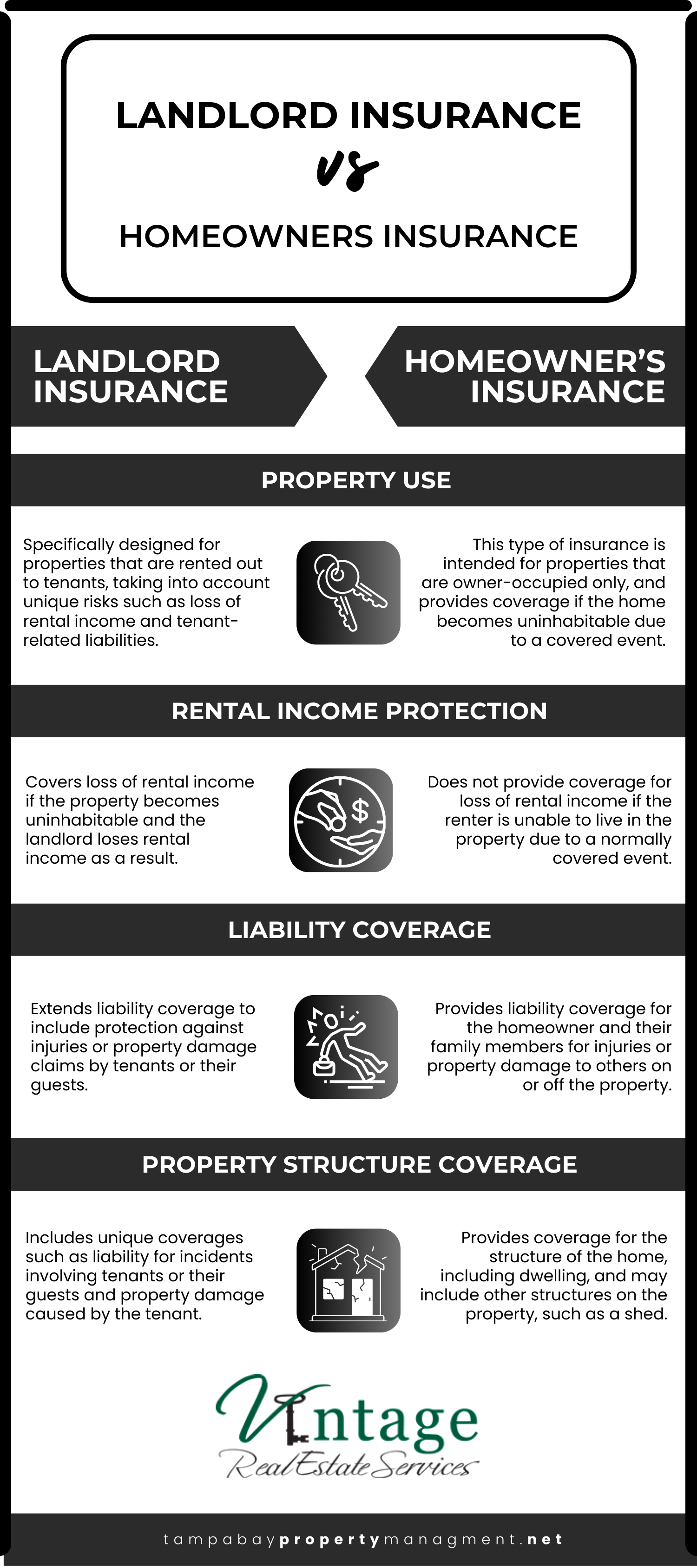

Landlord insurance and homeowners insurance are distinct types of insurance policies designed for different purposes, as they cater to the unique needs and risks associated with owning and occupying a property versus renting it out. It's important for property owners to choose the right type of insurance based on how the property is used. Here are some key differences between landlord insurance and homeowners insurance:

What Questions Should I Ask When Choosing Landlord Insurance?

When shopping around for a landlord insurance policy, asking the right questions could mean the difference between coverage for a qualifying event and financial disaster. Here are our top 15 recommended questions you should ask when choosing a policy:

What Types of Coverage Are Included?

You need to know the specific coverages offered, such as property damage, liability, loss of rental income, and any additional endorsements or optional coverages.

How Much Dwelling Coverage Do I Need?

You need to determine the appropriate coverage amount for the structure of the rental property to ensure it is adequately protected in the event of a covered loss.

What Is the Coverage Limit for Loss of Rental Income?

Know the limit of coverage for loss of rental income in case the property becomes uninhabitable due to a covered event.

Does the Policy Include Liability Coverage for Tenant-Related Incidents?

Confirm that the policy provides liability coverage for injuries or property damage claims related to the tenants and their guests.

Are Legal Expenses Covered?

Some landlord insurance policies provide coverage for legal fees in case of disputes with tenants, eviction proceedings, or other legal matters related to the rental property.

How Are Property Inspections Handled?

Be prepared if there are any requirements for property inspections and whether the insurance company has specific conditions for maintaining coverage.

What Deductible Options Are Available?

Exploring different deductible options and understanding how the choice of deductible can impact premiums and out-of-pocket expenses in the event of a claim.

Are Vacant Periods Covered?

Check if the policy provides coverage during periods when the property is vacant between tenants.

Is Personal Property Included in the Coverage?

Clarify whether the policy covers personal property belonging to the landlord that is left on-site for maintenance or repair purposes.

How Does the Claims Process Work?

Understand the claims process, including how to file a claim, the response time, and what information/documentation is needed to process a claim efficiently.

Does the Policy Cover Acts of Nature or Specific Perils?

Are natural disasters (“perils”) covered by the policy, such as fire, flood, earthquake, or other natural disasters? What additional coverage is needed for specific risks in the property's location?

What Security Measures Are Recommended or Required?

Many landlord insurance policies require security measures, such as alarm systems or deadbolt locks.

How Does the Insurance Company Evaluate Property Value for Coverage Purposes?

Understanding the method used by the insurance company to assess the value of the property for coverage purposes is crucial. Ask whether this is based on the property's market value or replacement costs.

Are Tenant Background Checks Required for Coverage?

Check if the insurance company has any requirements regarding tenant background checks or tenant qualifications and how these factors might affect coverage.

What is the Policy's Renewal Process and Premium Adjustment?

Inquire about the policy's renewal process, including whether premiums may be adjusted based on claims history or changes in the property's value, and if there are any discounts for long-term, claim-free periods.

Landlord insurance is a crucial investment for property owners, as it helps mitigate financial risks associated with renting out real estate. Before purchasing a policy, landlords should carefully review the terms and conditions, understand the coverage limits, and consider any additional endorsements or optional coverages that may be beneficial for their specific situation. Are you a landlord in Tampa and need help managing your rental? Contact us here.